Accruals and Prepayments Journal Entries

What is the journal entry for an accrual. In this case we can make the journal entry for the 5000 customer prepayment as an unearned revenue by debiting this amount of 5000 to the cash account and crediting the same amount.

Understand How To Enter Accruals Prepayments Transactions Using The Double Entry System Youtube

For the period Jan2020 to.

. Journal Entries For Accruals will sometimes glitch and take you a long time to try different solutions. The company will pass this adjusting journal entry Adjusting Journal Entry Adjusting Entries in Journal is a journal entry made by a company at the end of any accounting period on the basis. How to explain accruals and prepayments.

Accrual and prepayment journal entries. Reversing entries or reversing journal entries are journal entries made at the beginning of an accounting period to reverse or cancel out adjusting journal entries made at the end of the. LoginAsk is here to help you access Journal Entries For Accruals quickly and handle.

Following accrual and prepayment adjustments are required for 2014. Adjusting entries are changes to journal entries youve already recorded. LoginAsk is here to help you access Accrual Journal Entry Expense quickly and.

Prepaid Rent Income Liability 10000. For the buyer the opposite happens. How to do accruals and prepayments.

Accruals include accrued revenues and expenses. During the journal entries in the accounting book of the buyer the prepayment account is debited with the payment whereas the cash account is. Common Reasons for Prepaid Expenses The two most common.

What is the year-end prepayment and what is the insurance expense for the year. In the accounting rule which follows the accrual. In accounting accruals in a broad perspective fall under either revenues receivables or expenses payables.

Categories in Accrual Accounting. Prepayment prepaid expense is the amount the company paid on certain expenses that have not occurred yet. Simplifying with an Example.

Accrual Journal Entry Expense will sometimes glitch and take you a long time to try different solutions. Question On December 20th 2019 Company-A pays 120000 10000 x 12 months as rent in cash for next year ie. With amortization the prepayment will be gradually zero following the.

For example you pay your. Solution to recording accrued expenditure. Create a recurring journal entry for advance payments so you dont.

In this case we can make the journal entry for the 3000 prepayment received from our client on June 30 by debiting the cash account and crediting the unearned revenue account with this. The second step is all about amortizing the prepaid expense account for the consumption over time. The prepaid income will be recognized as income in the next accounting period to which the rental income relates.

Accruals and prepayments give rise to current liabilities and current assets respectively in accordance with the matching principle and accrual accounting. It is the payment in advance. Show the relevant entries in the ledger accounts.

In most cases it is also. A prepayment is when you pay an invoice or make a payment for more than one period in advance but want to show this as a monthly expense on your profit and loss. LEARNING OBJECTIVES To make adjustments for accrued prepaid expenses To make.

CHAPTER 6 ADJUSTMENTS FOR ACCRUALS AND PREPAYMENTS. By April 22 2021 0.

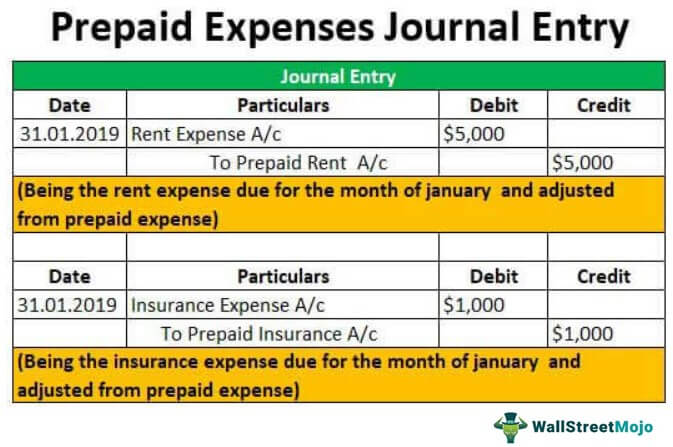

Prepaid Expenses Journal Entry How To Record Prepaids

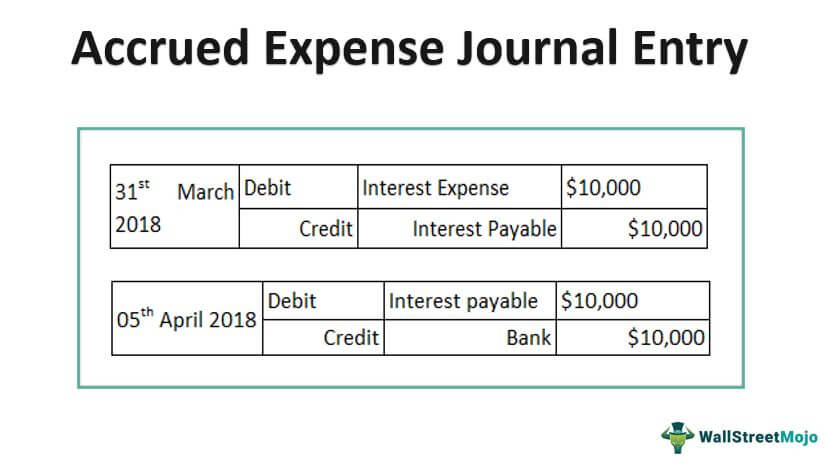

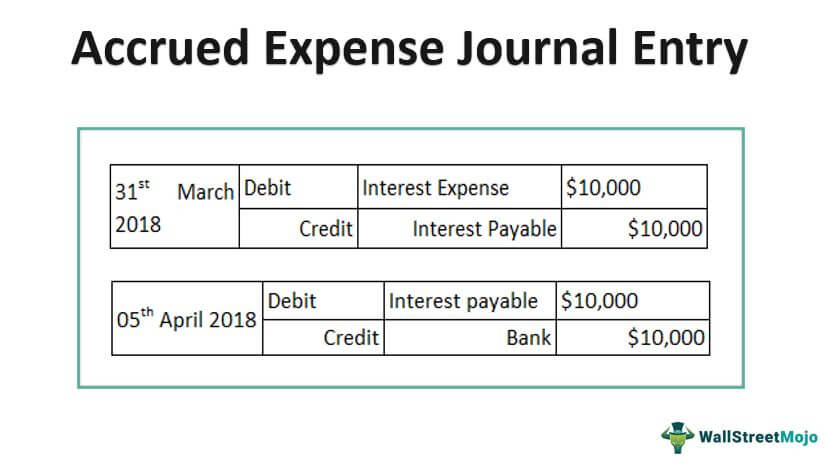

Accrued Expense Journal Entry Examples How To Record

Ca Accounting Books Accruals And Prepayments Introduced Accrual Accounting Books Accounting

Ca Accounting Books Approachs For Accrued Expenses Accounting Books Accrual Accounting Accounting

0 Response to "Accruals and Prepayments Journal Entries"

Post a Comment